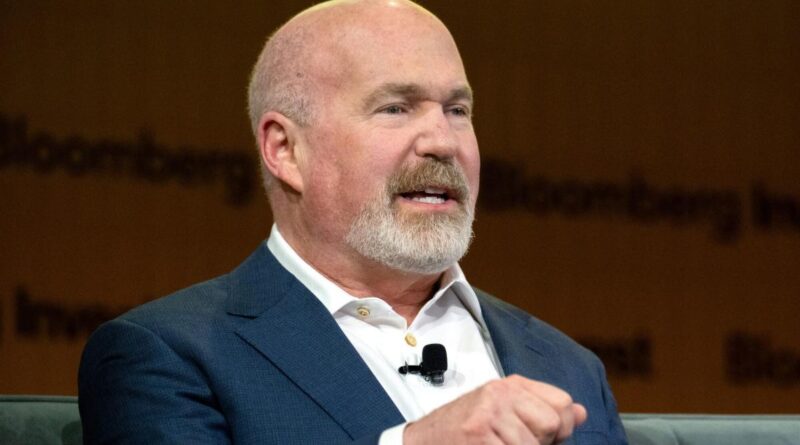

Cliff Asness is a ‘Special Old Man’ as the Markets Underperform

(Bloomberg) — Cliff Asness says he sounds like a “crying old man,” but that’s not stopping him from writing 23 pages into his latest thesis: Financial markets these days aren’t what they used to be. when it was.

Most Read from Bloomberg

The co-founder of AQR Capital Management has just published new research that amounts to a detailed explanation of the argument he has repeatedly made recently, namely that the market has underperformed during his more than 10-year career. thirty. .

The paper – prepared for the 50th anniversary edition of The Journal of Portfolio Management – “is as much opinion as it is quantitative research,” the billionaire admits. But he says the decisions have important implications for any investor looking to conquer Wall Street.

Asness, 57, writes: “I believe that the markets have not worked well in the 34 years since the information in my book ends. a long time, but it makes it difficult to do so. ”

In one sense, it’s a big call from a hedge-fund manager. His PhD advisor at the University of Chicago was Eugene Fama, the grandfather of what is known as efficient marketing theory.

In that worldview, trying to undercut the markets is a fool’s errand, but it is possible to get more profit by choosing stocks based on so-called factors, or qualities that reward those who carry them for bearing certain risks. It’s the philosophy at the heart of firms like AQR and Dimensional Fund Advisors, another venture founded by Fama proteges.

If Asness is right that the markets are not working well, it means that the investment process is getting harder and harder. It may take a little longer for the kind of strategy favored by AQR to come to fruition.

As for what caused the change, Asness says index investing, ultra-low interest rates and social media are all likely culprits. Finally he dwells on the latest “gamification” of business that can have the greatest impact, as it has produced many naive actors in the investment world.

“Whether this holds forever, I cannot say,” Asness writes in the paper, called The Less-Efficient Market Hypothesis. “It seems that throughout history new technologies are eventually adapted, and one day perhaps adaptation will make this piece obsolete. But for now, I think it has raised the bar for practical investment. well.”

Investment Strategies

So what’s an investor to do? Other market players should lean toward the new normal, Asness says, heeding the advice of the meme-stock investors he blames for new inaction: HODL, or hold on for dear life. He says that investors should strive to have the longest investment period.

Additionally, he encourages investors to learn from historical market trends. Check out the rates in progress. Don’t get caught up in focusing on everything in your portfolio, and see the big picture instead. Don’t mistake three- to five-year trends as permanent. Avoid private assets that can “wash” risk by hiding their true volatility. Always work to improve your processes.

And finally, if you don’t feel confident following his playbook, then switching to indexing is “the perfect choice.”

“The work is not easy, and the advice is clear, not a new expert!” Asness writes. But perfection is not the goal, and one can get better, maybe a lot better, and hopefully these ideas will help.

The time for self-evaluation comes as AQR is on the rise, having seen a strong start to many of its strategies in recent years as high interest rates continue to diverge. But this revival follows a period of inefficiency that lasted so long that some critics thought its methods were outdated.

According to Asness, inefficient markets also mean that there is value in new methods such as machine learning, alternative data and variable models that change the distribution of data over time. While the firm’s best performance is due to market cycles, AQR also allows machines to make more decisions, he said at a Bloomberg Invest conference in June.

Asness writes: “If the market is really underperforming’ the first task has become easier and the second more difficult – and the skills required to pursue good investments have changed.”

Best Reads from Bloomberg Businessweek

©2024 Bloomberg LP

#Cliff #Asness #Special #Man #Markets #Underperform